The story of Hollywood isn’t art. That existed long before (and will long after) this current iteration is transformed. The story of the Hollywood we know, is about studios being bought and sold, and in between, producing things we watched. A lot of those buyers, we would be shocked at. For instance:

In the 1950s, a music label called Decca, purchased Universal Studios.

NBC later merged with Universal, and then Comcast took it—all to say: institutions trade studios like assets, because they are.

The battle for Warner Brothers is about much more than movies, but we don’t have to act like it the first time something like this has happened.

This analysis focuses on Paramount’s case to the Warner Bros. shareholders—and how a presentation, positioned well—while Netflix plays the parallel public game.

But to do that, you need a deck that tells people why and how you are going to do what you say you are going to do.

The Deck That Launched 1000 Lawyers

Capital needs to flow to ideas. It is a commodity that needs a job.

Presentations are means to communicate what can happen when that money finds the right job.

A few key slides tie this all together. And they are tactics anyone can (and probably should) to communicate their own ideas. Take what works, leave the rest.

Here's a snapshot:

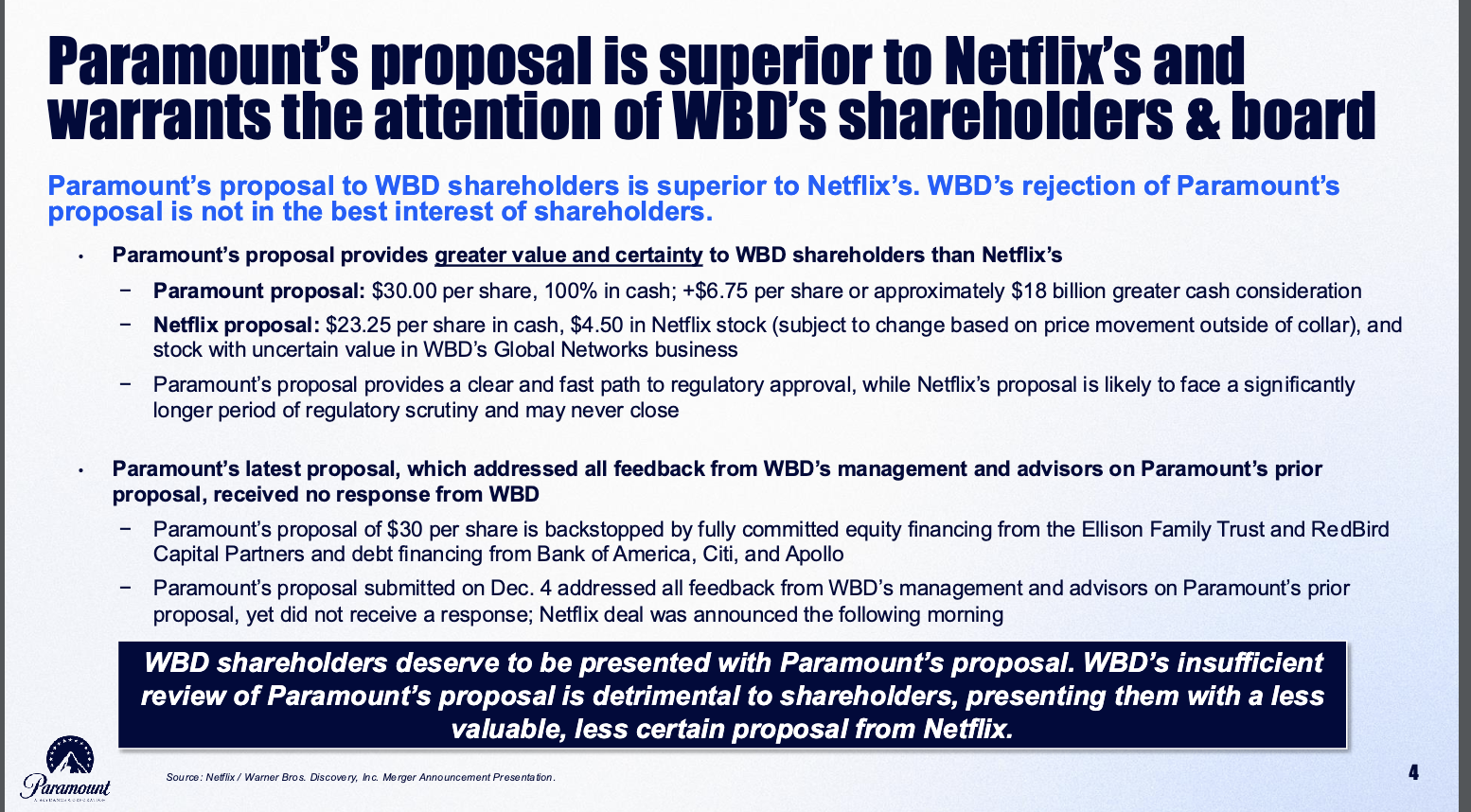

The Opener: Always BLUF (Bottom Line Up Front):

BLUF is a term used in military briefings to communicate critical information. You state the decisive takeaway first, then supply the supporting facts, assumptions, and caveats. It forces clarity, and prevents important information from being missed or buried.

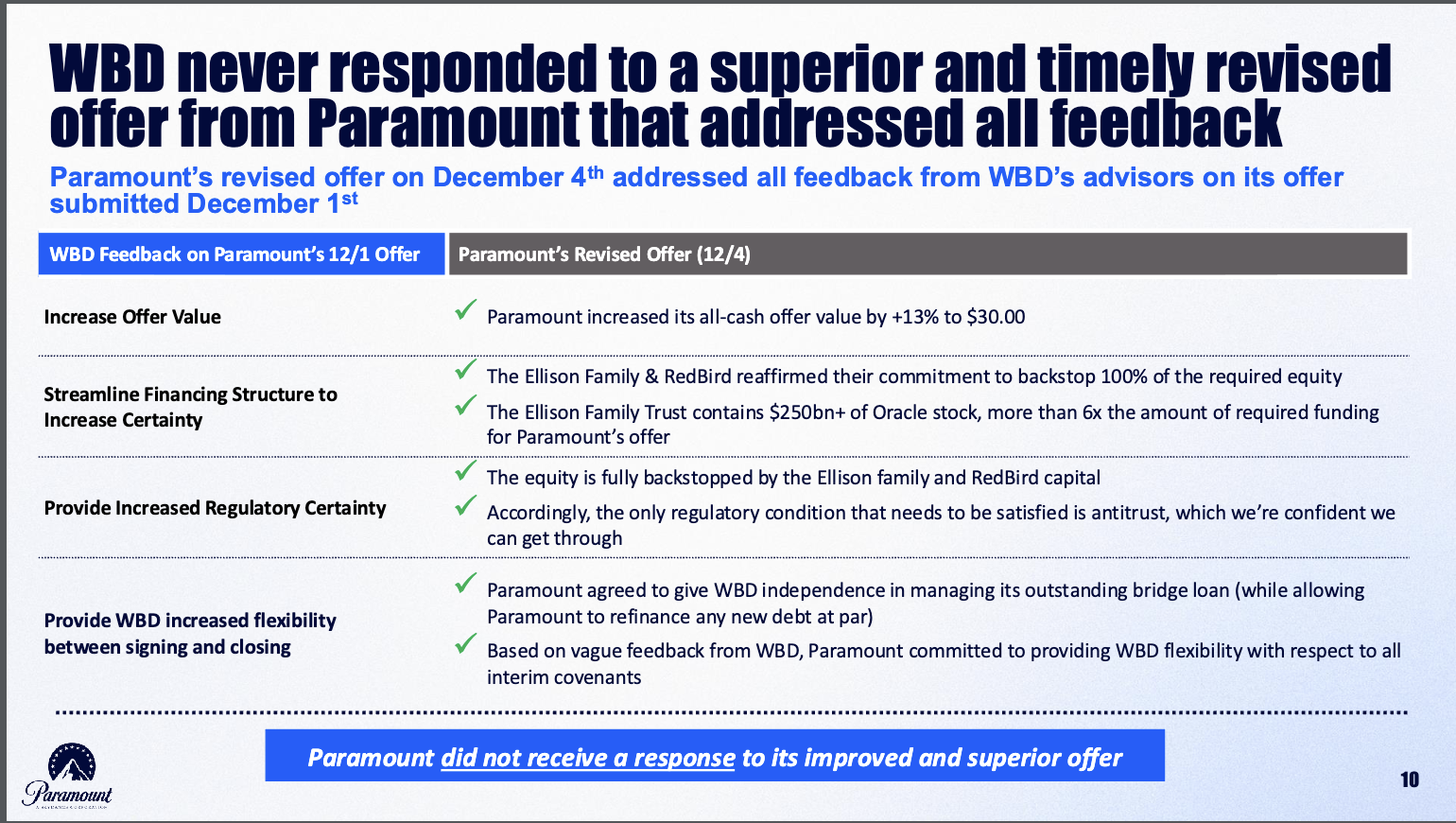

The ‘You Know What Time It Is” Slide

This is the crux of the argument - Paramount never got a call back when it revised its offer, so they are saying this puts the shareholders at a disadvantage.

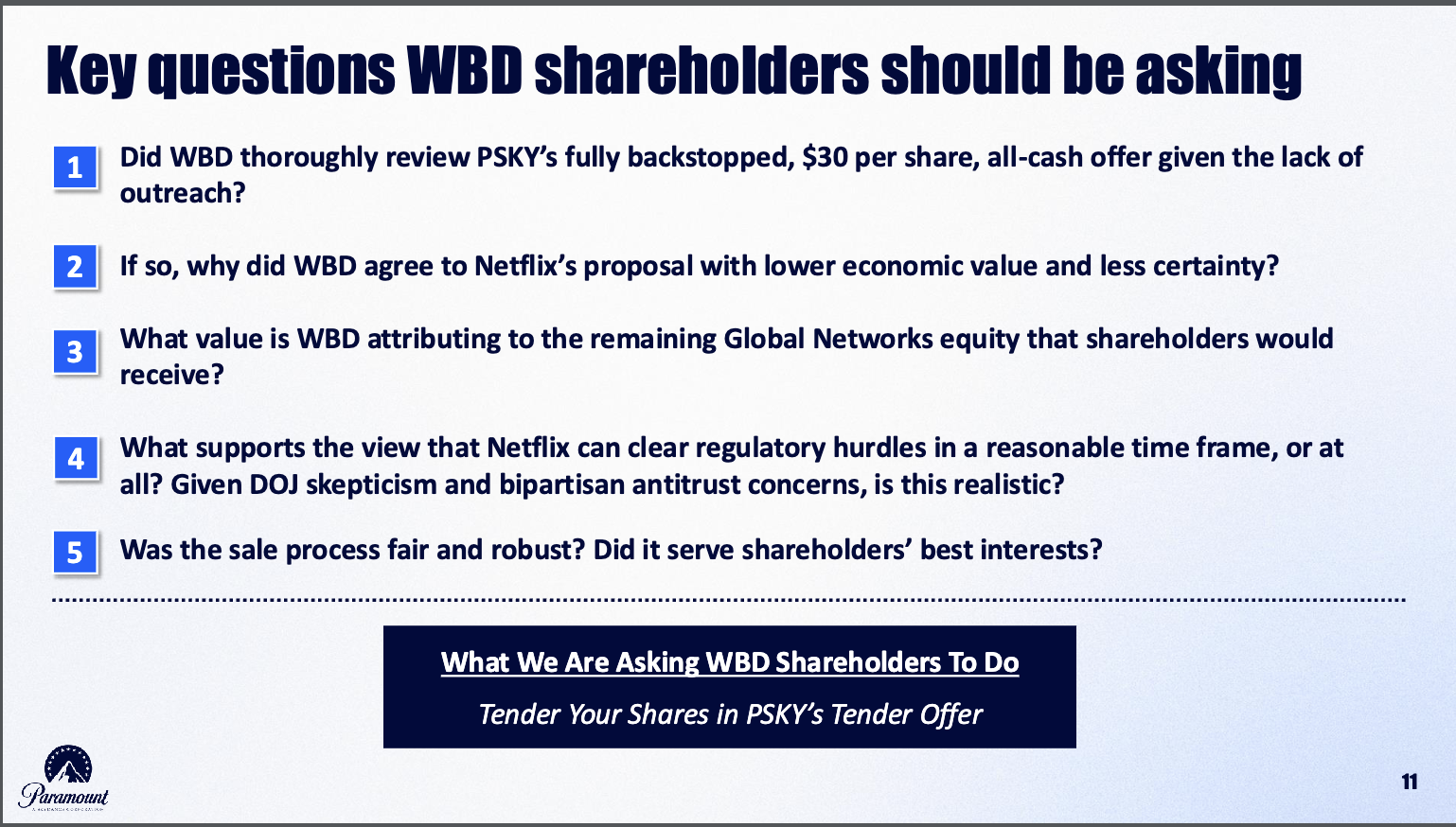

The ‘Clear Ask’ Slide

Frame skepticism about the rival bid’s true economics without overstepping—apply pressure, don’t libel.

The Business of Convening Slide

The bottom left quadrant deserves some time. NFL, MLB, March Madness, WNBA, PGA, and Champions League, are all institutions unto themselves. You layer in tentpoles and live rights, and you lift average CPMs, reduce churn, and increase distributor leverage—exactly the economics a board wants to see.

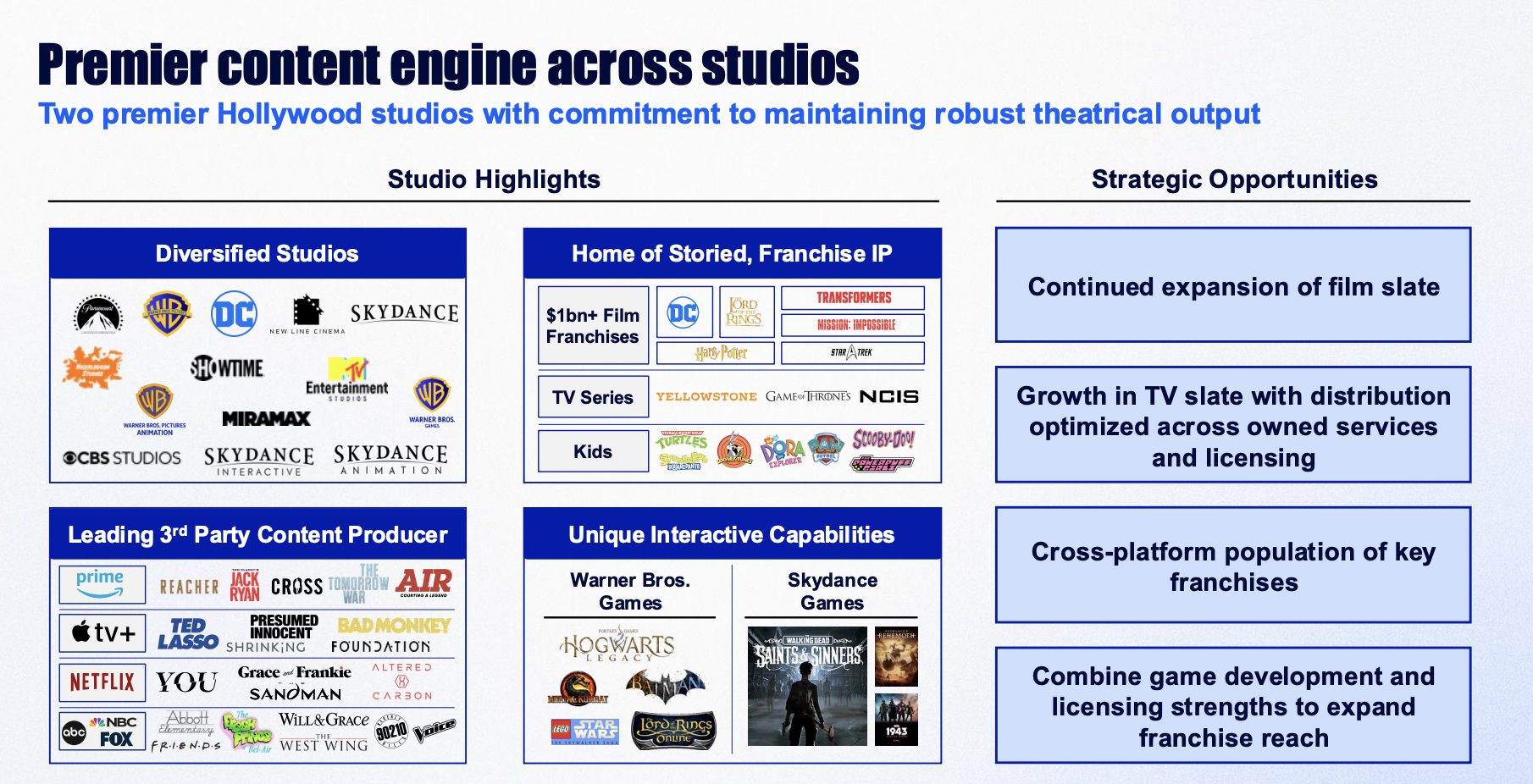

The Content Flywheel Slide

This is my favorite. SO. MUCH. IP.

Paramount by itself has its hands all over the place, and works with its rivals on particular deals and shows all the time.

If you’re a gamer, you know that Batman: Arkham Asylum went gold on PS5. What you might not know is how many other games they make.

Movies, cartoons, shows, games, live events, and products all flow out of franchises.

This is where the business compounds itself.

The war is private, the battle is public

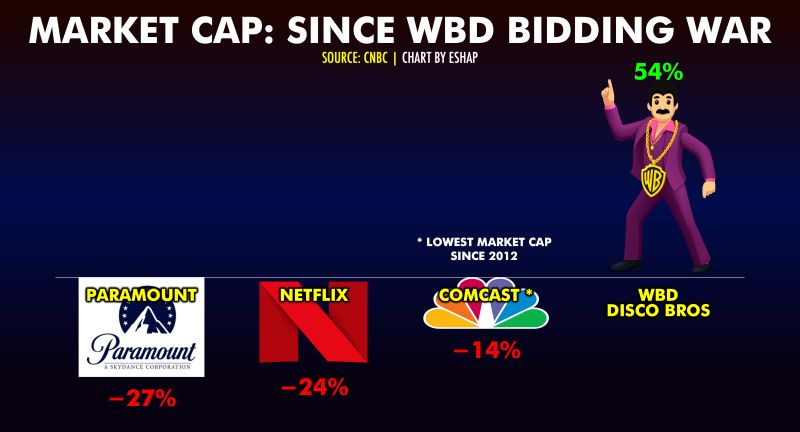

In the public markets, Warner Bros. is the short‑term “winner” so far—volatility and price action since bids surfaced have created leverage in the court of opinion.

But the average consumer is not going to go look at earnings number or a deck like the one you did. They are going to check their email though.

And Netflix will be there, with that gigantic N, playing offense:

Here's the CEO of Paramount, recapping that same deck, in under a minute:

Succession Season 5 Premiere

Different strategies, but the same determination: I need to win out in public sentiment, because we're going to court regardless. When the message is clear, you reinforce the talking points. Over, and over and over again.

The Allspark Deal

I am a lifelong Transformers fan. In the lore, there’s something called the Allspark; it a singular source of all the power that connects the Transformers. This singular power source that animates everything, including how they move and operate.

Both Netflix and Paramount are selling an idea of what Warner Brothers could become, if they win. What they actually do with it, will play out, but the drama of it, is what people are tuning in for. Whoever wins, will reshape something.

Before something even becomes a deal though, its an idea. Before its an idea, its a choice. And before it’s a choice, it’s a spark.